Why choose a rent-to-own? Rent-to-owns are popular with people who do not qualify to get a mortgage. There could be several reasons for this (especially with mortgage qualification getting tighter). This could be because the tenant-buyer lacks enough money for a down payment; they are self-employed, have poor credit history, lack continuous employment, or are new to Canada.

Rent To Own – What Are The Benefits For Me?

- Option to work towards home ownership, when ownership would not otherwise be possible.

- Gives you a chance to rebuild your credit

- Predetermined purchase price (regardless of future changes in market prices)

- Avoid potential power of sale (if you are the property owner)

What are the requirements to get involved in our rent to own program?

While there some stipulations that you must meet in order to qualify for rent to own, the entry requirements are much more lenient than trying to get a bank mortgage in Ontario. See below our list of conditions.

- Must have a stable income. You must be working AND earning an income.

- 5% purchase option deposit. This means we will agree on the sale price of the property and you will deposit 5% of the sale price as a future option to purchase.

- Terms up to 5 years. Our standard agreement for a purchase option is 5 years. We feel this will help to give you enough time to work on either your credit, or your down payment. If 5 years is not ideal, we will discuss with you terms which may work better for both of us, at our discretion.

- Standard landlord tenant board agreement signed.

- Agreement to receive credit counselling, if credit is not in good shape at the time of application

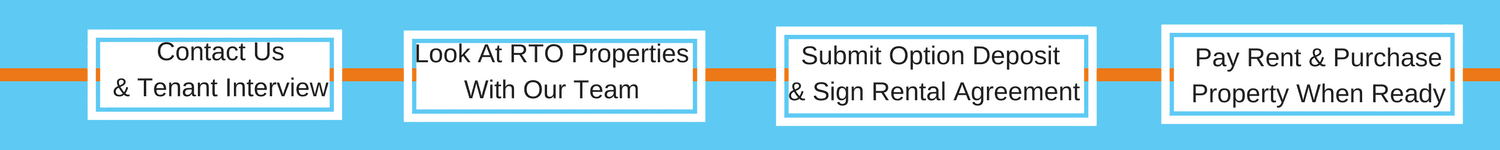

Rent To Own Process – Step By Step

- Tenant able to buy property early in term (tenant is able to purchase the property immediately)

- Tenant able to secure larger term deposit (in this case we can reduce the total monthly rent to reflect the greater term deposit)

- The house is worth more at time to sell ie housing market appreciation (tenant will be purchasing the property, and start with greater equity in the home than they would otherwise have)

Worst Case Scenarios (what will happen)

- Tenant defaults on monthly payments (we will keep your purchase option deposit)

- The term ends, and tenant still not able to buy the house (tenant can either move out, or we can discuss extending your term. NOTE: this is upon landlord discretion. You cannot expect a term extension if you have poor payment history, or do not take care of the property.)

- Tenant not able to secure term deposit (unfortunately they will not be able to enter in a rent to own agreement)

- The house is worth less at time to sell ie housing market collapse (tenancy term can be extended)

Are you ready to explore your home ownership opportunities? 416 Home Buyer is THE NUMBER 1 company to call. We work to provide you with the flexible options you need to secure your house.

Contact us today.